Farming looks mighty easy when your plow is a pencil and you're a thousand miles from the corn field. - Dwight D. Eisenhower.On Thursday evening, I was watching a Ken Burns* documentary on the Dust Bowl (boy, if that doesn't show you how cool I am...) and learned how "suitcase farmers" contributed to the ecological disaster. As I watched, I couldn't help but draw some parallels to investing.

|

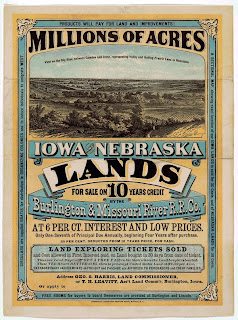

| Source: George Mason Univ. |

Now, put yourself in the shoes of these suitcase farmers. They must have thought, "I'm not sure why farmers have been complaining for generations and generations about farming behind hard. Plant a seed, let it grow, sell for a big profit. This is easy!"

Easy money can be made in difficult industries from time to time, but it doesn't remain easy forever.

Unsurprisingly then, when the Dust Bowl hit and devastated the Great Plains farming industry, the suitcase farmers fled. (Like clockwork, they returned during World War II when wheat prices recovered.)

The suitcase farming story reminded me of this thought I shared on Twitter a few months ago:

Everyone's a "long-term investor" when the market is going up. You see who really means it when the market is down.

— Todd Wenning (@ToddWenning) October 7, 2013

I remember writing this tweet out of some frustration. Have you noticed that during the market's strong run, there have suddenly been more buy-and-hold investors? Where were all these people a few years ago?As recently as 2011, some of them were saying things like:

- "Three weeks ago, I would have said: 'We're in it for the long haul' ... But we don't want to see these $200,000 to $300,000 swings in performance in a $5 million account."

- "Stocks that have a 5% dividend are great, but what kind of consolation is that going to be if they're down 10%?''

- "While [cash] might not be earning anything ... that cash at least isn't losing value.''

I don't want to come down too hard on investors that thought this way at the time. It's not easy investing/managing money in challenging markets and, hey, the market could have fallen further and they would have looked smarter than us in the shorter-term.

Still, you can't help but smile when investors are now saying things like:

- "There might be small corrections here or there, but [the market] always seems to spring back up."

- "Frankly, from 2009 until recently, I wanted to stay very conservative, (now) I want to get more aggressive."

- "It's like, 'Oh, why were we so pessimistic back then?' That kind of remorse never feels that good."

Friends, I have no idea where the market will end up in 2014. I've heard compelling arguments made by bulls and bears alike. What really concerns me is the optimistic shift in the average investor's opinion of equities. Whether you study market history or suitcase farming, when expectations of easy profits are this high, it's a good time to be vigilant.

Good reads this week:

- Vaccinate Yourself Against 2014 Predictions with Silver Medals - Total Return Investor

- The Best Financial Advice I Ever Got (or Gave) - WSJ via Yahoo! Finance

- Just in Time Information Gathering - Farnam Street

- Long-Term Thinking: 1800-2013 - Morgan Housel

- Debating Passive vs. Active Investing - Monevator

Quote of the week:

The best financial advice I ever got was "Price yourself high and see what happens." - Scott Adams (creator of Dilbert)Happy New Year!

Best,

Todd

Follow @ToddWenning

*I absolutely adore Ken Burns' documentaries. The Civil War and Baseball are masterpieces.