Assuming the backtest is accurate, the results of the SGQI index are intriguing:

Admittedly, I have been unable to find SG's original white paper on the Quality Income Index (if you have a copy, please let me know), but judging from the prospectus for a security linked to the QI index, here's the rundown:

The SG Global Quality Income Index (the Index) (Bloomberg: SGQINTR) is based on two basic principles. The first is that historically dividend yield represents the biggest component of equity returns and the second is that often equity investors are not rewarded for buying higher risk stocks. (my emphasis)

I've picked up from various other sites that the SGQI index also focuses on dividend sustainability and balance sheet strength while giving less value to traditional dividend cover metrics ("Our research suggests that good dividend cover is not a good indicator of how safe that dividend is in the future").

So is the SGQI the perfect methodology for approaching dividend investing? From what I've read thus far, I agree with some points and others I have remain skeptical about.

Where I Agree

#1: Dividend paying stocks as a group tend to outperform

There's nothing revolutionary about SGQI's findings, as there are myriad studies supporting dividend-paying stocks (as a group) outperforming the market. Here are two practical reasons why I believe these studies have merit.

First, dividend payouts are "sticky" -- once they're started they're difficult to reduce or eliminate -- so management has to consider those regular cash outflows when making capital allocation decisions. A management team flush with cash is like the proverbial man with a hammer and they are prone to "empire building" through a rash of acquisitions. After all, it's in their best interest -- the bigger the company becomes the more they can demand from a pay perspective. Sadly, acquisitions (especially large ones) typically benefit the shareholders of the acquired company and not those of the acquirer. Having a regular dividend cash outflow, therefore, reduces the pile of cash at management's disposal and reduces the odds that management will invest in acquisitions that destroy shareholder value.

Second, a company that pays a regular and (ideally) an increasing dividend is more likely to be confident in the longer-term prospects for the company. By regularly increasing the dividend, management is indicating that it believes it will be able to afford that payout in the future. In addition, paying a regular dividend allows shareholders to immediately share in the company's success and realize cash flows alongside the company. Non-dividend paying companies, on the other hand, retain all cash flows to reinvest in the business and are thus implying that they can earn a higher rate of return on your cash than you could if they handed it back to you. There are some rare cases (think Apple under Steve Jobs) where that's reasonable and desirable, but it's not common for companies to be able to consistently reinvest all their cash at rates above their cost of capital.

#2: Balance sheet health is important

Rapidly deteriorating balance sheet health was one of the major reasons that companies cut their dividends during the financial crisis. Indeed, 2007 set M&A records and a good number of companies overextended themselves with acquisitions thinking the good times would continue. When the financial crisis hit, these companies were often in danger of breaking their debt covenants, risked credit rating downgrades, or struggled to refinance near-maturity debt. As a result, dividend payouts were naturally cut in an effort to shore up cash and repair balance sheet strength.

To reduce the risk of balance sheet-induced dividend cuts, I look at a company's interest coverage (EBIT/interest expense) track record and want to see at least 3x cover on a consistent basis. Another good rule-of-thumb is to avoid companies with net debt-to-EBITDA ratios above 2x. Unless that company has sustainable competitive advantages and stable margins, an economic downturn could quickly call its dividend into question.

#3: Underlying business economics matter

SG stresses that quality income payers must have both a robust balance sheet and robust underlying business economics. Indeed, it is critical to have both.

If the company's competitive position is deteriorating, it's probably best to pass on it as an investment even if it's currently in good financial health.

#4: Don't chase yield

As I've said before, ultra-high dividend yields can mean ultra-high risk of a dividend cut. The market doesn't often give away low-risk 8%-plus yields, so it pays to be skeptical of any yield that seems too good to be true. I really liked this chart that SG put together that compares realized and forecast dividend yields and provides statistical support to the notion that the higher the initial yield, the more likely that yield is unsustainable.

#5: Boring stocks are often undervalued

In The Future for Investors, Wharton professor Jeremy Siegel revealed the best performing U.S. stocks between 1957 and 2003. The best performing stock was tobacco giant Philip Morris (now Altria), which generated an incredible 19.75% annualized return over that period. Other top-performers on the list included Coca-Cola, Pfizer, Heinz, Unilever, and Wrigley. These companies may not have operated high-octane businesses, but they earned steady profits and had sustainable competitive advantages that helped them maintain pricing power over many decades. This translated into incredible returns for their long-term shareholders.

Indeed, in Peter Lynch's classic One Up on Wall Street, he lists thirteen signs of an attactive stock. Among them are several recommendations to look for "boring" stocks, including: It sounds dull - or, even better, ridiculous; It does something dull; It does something disagreeable; There's something depressing about it; and It's a no-growth industry.

Boring, high-quality stocks are attractive long-term investments precisely because they aren't going to grab a lot of investor attention and are thus more likely to be undervalued. Who wants to brag to their friends that they picked up 1,000 shares of a company that makes cleaning products? It's much more fun to talk about the stocks du jour -- the Facebooks of the world. Financial headlines love a good high-growth story and you won't see the FT flashing a story about a company that's raised its dividend for 10 years in a row, but the latter are exactly the types of companies you should look to own as they have been creating real long-term shareholder value.

Reasons to be skeptical

#1: Always be wary of backtests

The SGQI backtest reminded me of the backtests done by WisdomTree when it was launching its line of dividend-weighted ETFs. As I wrote in 2009, WisdomTree's dividend-weighted model supposedly would have worked great in the past, but struggled to produce the same results when the dividend landscape dramatically changed during the financial crisis amid the hundreds of dividend cuts between 2008 and 2009.

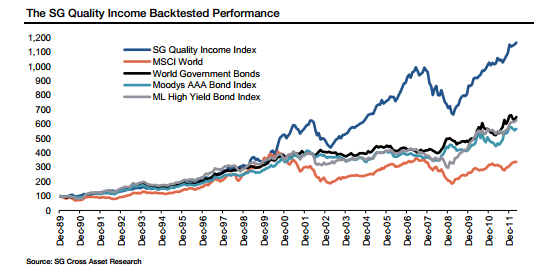

Judging from the performance chart (the first one on this page), SG studied the period 1989-2011. 22 years is a decent amount of time, but the data population is relatively small (8,030 days) and subject to more error.

SG's backtest also assumes no transaction costs or commissions -- both of these things (as well as taxes) are critical components to realized returns and can't be overlooked.

Backtesting is a fine way to test a strategy or theory -- so I'm not critical of SG using a backtest -- but it's important to take backtests with a grain of salt as they are backward looking and investing is a forward-looking activity. Specialized or formula-based strategies that worked in the past may not work in the future.

#2: Pre-buybacks

A lot has changed in the dividend world since 1970. At the time, stock buybacks were essentially non-existent and cash dividends were the primary way of returning shareholder cash. Today, a lot of companies prefer buybacks to dividends for a number of reasons -- they aren't as sticky as dividends, they can artificially increase EPS, and can increase financial leverage.

Even though I prefer dividends to buybacks (a subject for another post), there's no doubt that buybacks are now a force to be reckoned with and thus should be considered in any dividend-focused backtest:

|

| Source: Aswath Damodaran |

#3: Dividend yield as the biggest component of equity returns

Recall that expected return is approximately equal to starting dividend yield + dividend growth +/- P/E re-rating.

SG argues that dividend yield was the biggest component of equity returns between 1970 and 2011. That might be true and I don't have all the data they used to compile their chart (the second chart from the top), but using some annual data for the S&P 500 between 1960 and 2011, I put their findings to the test.

I took the starting dividend yields each year between 1960 and 2001 and measured the rolling 10-year annualized changes in dividend growth and P/E over the subsequent 10-year period.

|

| Data Source: Aswath Damodaran |

My (less scientific...hopefully) findings were a little different from SG's. The median dividend yield over this period was 3.4%, the rolling 10 year median dividend growth was 5.4%, and P/E contribution was 0.5%. My data seems to suggest that it's, in fact, dividend growth and not dividend yield that has been the primary driver of long-term equity returns. At least in the U.S.

Moreover, average dividend yields were much higher in 1970 than today -- 3.46% in 1970 vs. 2.07% in 2011 -- so SG's results might be a function of the chosen starting year. Thanks to the widespread use of buybacks as an alternative to dividends, I don't think we'll get back to consistent 3%-plus average dividend yields in the U.S., so I doubt that dividend yield will be the largest component of equity returns over the next 40 years.

#4: Dividend cover less important

I do agree with SG that balance sheet health needs to be considered when evaluating the quality of a dividend-paying stock, but I would be interested to see the data behind their claim that dividend cover was not a good indicator of dividend sustainability. Intuitively it doesn't make sense. A company that consistently covers each dollar of dividend with $3 in free cash and earnings will likely pay a more sustainable dividend than one that covers each dollar with $1.20 in free cash and earnings.

If they were using annual dividend cover data rather than normalized dividend cover data (a five year average), I can see why dividend cover metrics may be less explanatory. That's because in any given year highly cyclical companies may have great coverage metrics if the economy is strong, but the coverage can quickly deteriorate in a recessionary year.

When you're measuring a company's dividend health, I recommend using at least five years of data (preferably more, if available) to see how dividend cover has changed over the years. For cyclical companies, use normalized figures to avoid the trap of misleading fundamentals in peak years.

#5: Lots of money flowing to dividends

I wasn't at all surprised to hear that SG was launching an ETN that tracks the QI index. Fact is, with bond rates so low right now there's a ton of money flowing into dividend-focused ETFs and funds, and just like any industry that's receiving a lot of capital it naturally inspires innovation in the space. Looking back, some of those innovations will be helpful to investors while others won't. Therefore, it's important for investors to be skeptical of any new mouse-trap aimed at dividend investing today.

#6 Dividend paying stocks are not like bonds

In SG's advert for the QI ETN, they state: "quality income stocks can provide the bond-like characteristics of income and capital safety, but also offer scope for capital growth like equities." If that sounds too good to be true, that's because it is.

With a stock (no matter how high quality it might be), your principal and dividends are at total risk, whereas with bonds there's a contractual obligation for the company to pay you back interest and principal on certain dates. What SG is actually describing in that sentence are convertible bonds that allow you to convert your bond into equity at a predetermined price if the stock price rises, but also offers downside protection in that you can simply hold the bond to maturity if the stock declines.

While I think that income-minded investors with a long time horizon should consider a diversified dividend-portfolio in this low bond-rate environment (in the context of their individual risk tolerance, investment objectives, etc.), it needs to be made clear that bonds and stocks have very different risk profiles.

Bottom line

I applaud SG for adding additional insight and research into the field of dividend investing, but I won't be purchasing the QI ETN.

(Note: I had some publishing problems with this post. If you notice any minor changes, it's because I had to rewrite some sections.)

--

A few good reads this week:

Howard Marks' new memo on risk and hedging.

Monevator (UK) on the absurd levels of banker pay.

Is manufacturing moving back to the US? (The Atlantic)

And finally...what cricket looks like to Americans:

Have a good weekend!

Todd

@toddwenning on Twitter